Why You Should Care About Medicare

The Amount You Invest Can Be Less Important Than When You Start Investing

What you need to know

Healthcare continues to be one of the largest expenses in retirement.

Medicare can help address healthcare costs. However, the complexity of the programs and their eligibility requirements can make them difficult to understand.

Your financial professional can help you see how your choices may ultimately impact your financial planning for retirement.

Americans are living longer than ever before. Life expectancy of a newborn in the United States today is almost 76 years.1 But there’s a rub to our lengthy life expectancies: dramatically higher healthcare costs.

The cost of medical expenditures is steadily on the rise. Medical costs are expected to increase by 7% in 2024.2 Having the right Medicare plan in place can help keep these expenses manageable in retirement.

However, Medicare's complexity can make it all seem somewhat confusing. Imagine being asked to put together a jigsaw puzzle without having seen the picture on the box lid first. That’s how many of us feel as we begin navigating our options and planning for what’s next.

Here are a few basics everyone approaching retirement age should know about this important component of planning for the future.

What Is Medicare?

The federal government began playing a direct role in our healthcare with the 1966 launch of Medicare and its sister program, Medicaid. Medicare’s goal: provide affordable national health insurance for older Americans.

Who Is Eligible?

You are eligible for Medicare if:

You're 65 or older, AND

You or a spouse paid at least 10 years of Medicare taxes.

People younger than 65 with qualifying disabilities and medical conditions may also be eligible.

What Are the Different Parts of Medicare?

There are four parts to Medicare.

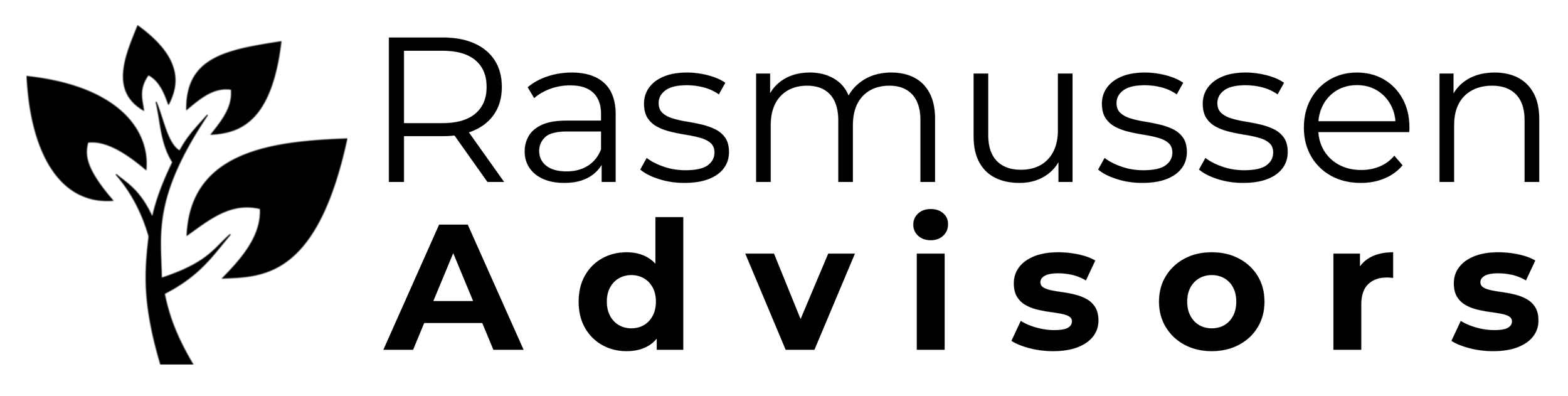

Medicare Part A—This is hospital coverage.

Medicare Part B—This is medical coverage. There is a monthly premium for this coverage.

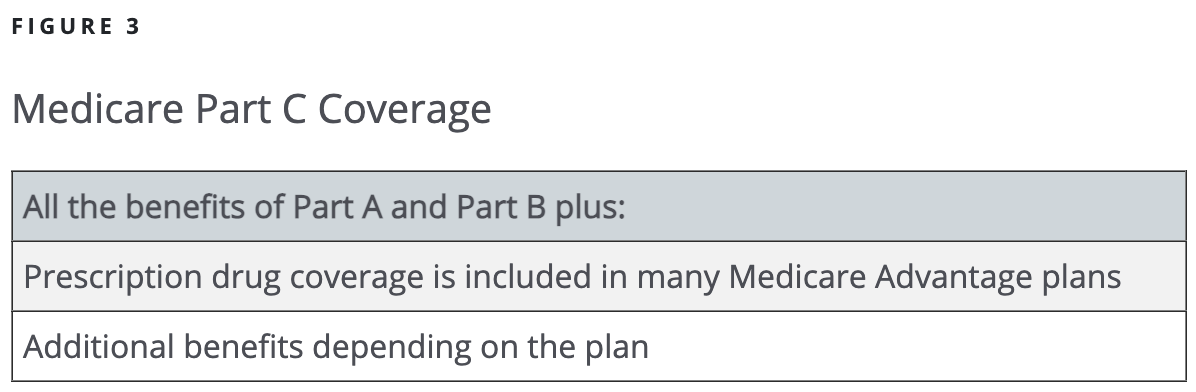

Medicare Part C

This is private insurance. More frequently called Medicare Advantage, these are Medicare-approved health insurance plans available through private insurance companies. Those enrolled in these plans still have to enroll in the Original Medicare plans (Parts A and B), but their coverage comes from Medicare Advantage. Most Medicare Advantage plans offer prescription drug coverage, too. In addition, there are other private plans besides Medicare Advantage.

Medicare Part D

This is prescription drug coverage. It’s a federal program that helps subsidize prescription drug costs for Medicare enrollees—all who are enrolled in Original Medicare (Part A or Part B) and some of those with Medicare Advantage (Part C). There is a monthly premium for coverage. Be aware how it will affect your other drug coverage.

How Much Does Medicare Cost?

As with most insurance plans, you'll pay premiums no matter which plan you end up choosing. You’ll also have deductibles, copayments, and coinsurance. The amount depends on the plan you select.

What Is Not Covered by Original Medicare (Part A and Part B)?

You may be surprised to learn that most dental care, eye exams for prescription glasses, hearing services, routine foot care, and long-term care are among the list of what's not covered by Part A or Part B. Medicare Advantage (Part C) plans typically cover these services.

When Can I Enroll?

Your initial enrollment period is your first opportunity to enroll. You can enroll for Original Medicare (Part A and Part B) beginning three months before you turn 65 until three months after. Even if you still have employer coverage, you need to apply for Part A.

If you missed signing up, you can enroll in Part A, Part B, or both between January 1 and March 31. The enrollment period for Medicare Advantage (Part C) and Part D is April 1 through June 30. To change a plan, the window opens October 15 and runs until December 7 every year.

Be aware: Penalties may apply for late enrollment or if you miss your initial enrollment window.

What if I Delay Enrolling?

If you don’t enroll in Original Medicare (Part A or Part B), it could cost you. For each year you wait to enroll in Part A, you will be charged an additional 10% for twice the time period you waited. For example, if you were two months behind, you’d pay 10% extra each month for four months. For each 12-month period you wait for Part B, you’ll pay 10% extra for however long you have Part B.

If you’re working beyond age 65 and are covered by your company’s insurance, you may be able to put off enrolling in Part B without facing penalties.

How Does a Medicare Supplement Insurance Plan Fit?

Private insurance companies offer optional supplemental plans to help with out-of-pocket expenses, such as deductibles, premiums, and copayments, for those who are still enrolled in Original Medicare (Part A and Part B). This is different than Medicare Advantage (Part C) because it works alongside Original Medicare (Part A and Part B) instead of being an alternative. Your open enrollment window for these supplemental plans—often called Medigap—begins in the first six months after you turn 65 or older and enrolled in Medicare Part B. Make sure you enroll during this period or you might not get accepted once the window closes.

How Do I Keep up on the Latest Developments in Medicare?

Visit the official Medicare website at Medicare.gov today. You can also keep up-to-date by following @MedicareGov on X (formerly known as Twitter) for all the latest news.

Have More Questions?

This list is simply a starting point for you to begin considering your options and how they may impact you. Your financial professional can help. Talk with him or her to see how your choices may ultimately impact your retirement.

Source: https://www.hartfordfunds.com/practice-management/client-conversations/investing-for-retirement/why-you-should-care-about-medicare.html